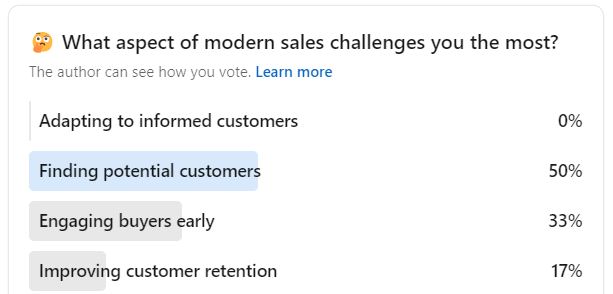

Results of our recent poll indicated that the top two challenges faced by sales organisations are “finding new prospects” and “engaging with customers early”. This isn’t surprising in today’s increasingly challenging sales environment, and perhaps controversially, they are two sides of the same coin.

In order to effectively find new prospects you need to engage with them early in their buying cycle, often before they have actively started a buying cycle. The challenge here is identifying what you can say that will compel them to talk to you.

Before considering various outreach strategies, you need to start with the more fundamental question: Who should we reach out to? From there, we can identify why they may talk to us.

Who should we reach out to?

Everything starts with identifying your ideal customer profile (ICP) which is a description of the type of company that is most likely to buy your product or service.

So how do we identify our ICP?

Traditionally, an ICP includes descriptors such as industry, size, location, budget, pain points, goals, and decision-making processes. This is typically achieved by doing the obvious: looking at past successes. But this isn’t going to work in a “buyer-centric” world.

Instead, reflect on why your best clients chose your offering. Why did they buy from you? Consider the circumstances at the moment of first contact: Did you have a unique offering? Had you worked there before? Was it a seller’s market, resulting in numerous daily inquiries? Why did you win? Was it because you were better than the competition in terms of price, features, or service?

Now look forward, how does this knowledge of the past help you find new customers? In many cases I suspect the answer is, it doesn’t.

If you believe in the concept of selling with a Buyer’s Perspective, at what stage was the buyer when they contacted you? Were they at the ‘Why Change?’ stage, or had they already done the heavy lifting and were at ‘Change to Who?’.

(I would argue that looking back just reinforces the adage that “the past is not necessarily a predictor of the future”)

Now it’s time to create a “Buyer Centric ICP” one that identifies organisations who have a reason to change, preferably one where you can collaborate with them to identify the reason to change, and build the solution criteria.

Building your buyer-centric ICP

Start by identifying the external drivers that will build a need to change and try and quantify the associated risk/opportunity.

- Industry Drivers – Regulation, technology, general trends (opportunities for FOMO), ESG, DEI, etc.

- Country/regional drivers – Environmental, Political, Legislative, Social

These will give you the broad reasons for change that organisations must be aware of.

Don’t stop there, if you want to be truly compelling you need to identify internal drivers that reinforce the need to change.

- Strategic drivers, typically these will be about growth and expansion (or managed decline/survival) as well as anything that generates stakeholder value, e.g. ESG

- Operational drivers, these will focus on process changes, cost savings, specific projects

- Personal drivers, look for people new into a role looking to make a difference

You are looking to find specific reasons to change that can be connected directly to a specific stakeholder who could become your champion.

Now you understand both the external and internal drivers you can build out your target ICP:

- Industry type

- Operating in these regions

- Of this size and structure

- With this strategy

- Addressing these operational issues

- With someone new in this role

By all means, look back at historical data to identify patterns, but remember the profile of your largest customer may not match your new ICP for lots of historical reasons, and this is okay.

Don’t be put off if, as a result of this, your “target market” reduces substantially. You’re now being realistic as to who you should contact. Let’s maximise the value of every minute and stop wasting time talking to people who do not currently have a need to change.

How to use your ICP to engage with customers early

Once you have identified your target ICP you have to be equipped to engage with them. What you need is a story that drives the need to change:

Identify the insights that reinforce the need to change:

- Start with the external drivers for change as these can be used for a broad campaign on the need to change

- Once you have responses to the broad campaign, build insights, with quantifiable outcomes, that address the internal drivers of the company that responded.

Turn these into stories and messages that can be used in your initial outreach campaigns:

- Consider using the same approach for your Account Based Marketing (ABM)

- Combine the internal and external drivers to build a compelling case for change

Resist the urge to talk about yourself, your products, and your successes. By properly identifying your ICP you can focus on them, the risks and opportunities they are likely to face and the quantifiable impact of addressing identified challenges.

To re-emphasise my earlier point: focus on quality not quantity. If your new ICP reduces the number of companies you speak to then that gives you the opportunity to have better conversations with people who will gain value from the conversation.

Remember timing and context is everything, as highlighted by Hans Bunes. Hans describes how he separates the “Who” from the “When”. This helps you identify if your ICP is a good profile match (high fit), but not ready to discuss change (low engagement) versus one who is already thinking of change (high engagement).

Early engagement with people who recognise the need to change will result in a much higher conversion rate, more effective salespeople and generally more connected sales and marketing organisation.

Wrapping up

If Einstein was a marketing expert and we asked him what’s the definition of ICP insanity, he would probably reply “using the same ICP model that worked when we sold with a seller’s perspective and expecting the same results now we operate in a buyer-centric market”. Now is the time to revisit your ICP so that it identifies those who will be open to a conversation about change.